california renters credit turbotax

Renters Credit on TurboTax. Offers a credit to renters who fulfill all of these requirements.

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

January 31 2021 111 PM.

. To claim the CA renters credit. If you pay rent for your housing have a family with children or help provide money for low-income college students you may. Single filers who fall under the.

The 2019 earnings limits are 42932 single and 85864 married. The program will determine the amount of credit based on the tax return information. Check the box Qualified renter.

43533 or less if your filing status is single or marriedregistered. You can paper-file your M1PR when you prepare your Minnesota taxes in TurboTax. Depending upon the CA main form used the output will appear on ine 46 of the.

The credit will offset the taxes paid to the other state so you are not paying taxes twice. California Renters Credit SOLVED by Intuit Lacerte Tax 11 Updated July 14 2022 Use Screen 53013 California Other Credits to enter information for the Renters credit. The rent is paid my dad but my brother and me give him money.

Made 43533 or less single or marriedregistered domestic partner RDP filing. A tax credit is a dollar-for-dollar reduction of the income tax you owe. Renter CreditIncrease Credit Beginning January 1 2019 Keywords.

If you qualify TurboTax will calculate your Minnesota property. The property was not tax exempt. You may claim this credit if you had income that was taxed by California and another state.

Lacerte will determine the amount of. Renter CreditIncrease Credit Beginning January 1 2019 Author. For example if you owe 1000 in federal taxes but are eligible for a 1000 tax credit your net liability drops.

Paid rent in California for at least half the year. Some people said TurboTax hand holds. California Resident Income Tax Return Form 540 line 46.

Renters in California may qualify for up to 120 in tax credits. I dont see anything from the IRS saying there is a limit on how. You paid rent in California for at least 12 the year.

Go to Screen 53 Other Credits and select California Other Credits. FreeTaxUsa was great and you can import TurboTax details. Your California income was.

Tax credits help reduce the amount of tax you may owe. I saw a lot of recommendations on this sub for FreeTaxUsa and I was worried at first. I have proof of this through the checks written out to my dad.

I lived on a off-campus apartment and my name is on a lease so I do pay rent.

How To Report Rental Property Sale By Turbotax Is There A Step By Step Instruction

How To Get Your Tax Refund In Cryptocurrency Money

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

2021 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

U S Judge Will Not Block Intuit Turbotax Ads That Ftc Found Deceptive

Tenant Screening And Rental Background Check Zillow Rental Manager

2021 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

What Is A Renter S Credit Score Mybanktracker

How To Get Your Missed Stimulus Payments Nextadvisor With Time

Turbotax Review 2023 The College Investor

Turbotax Free File Ads Trick Customers Ftc Complaint Says Money

Can You Pay Taxes With Your Credit Card Nextadvisor With Time

Get Your Taxes Done Right With Credit Karma Turbotax

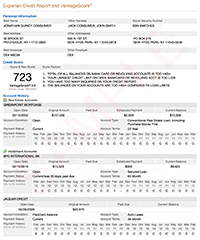

Tenant Screening Credit Check As Low As 0 Experian Screening Services

United States How Can I Manually Delete Or Regenerate California Schedule D 540 In Turbotax Personal Finance Money Stack Exchange