city of cincinnati tax abatement

The abatement currently works this way. The City of Cincinnati government is dedicated to maintaining the highest quality of life for the people of Cincinnati.

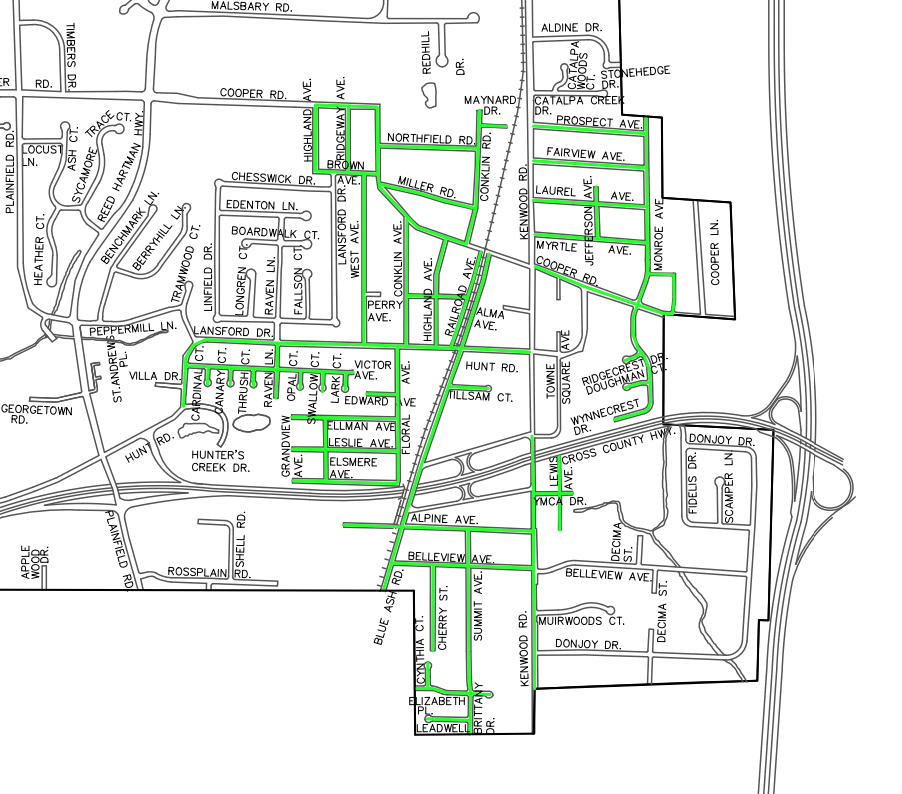

The Blue Ash Tax Abatement Buildcollective Com

The City is focused on economic development to create jobs committed.

. The Cincinnati Residential Tax Abatement program minimizes property owners taxes by allowing them to pay taxes on the pre-improvement value of their property for 10-15 years. Send Application and Fee to. But did you kno.

Some council members argue development would. The tax abatement rules for buildings that received permits on or before January 31 2013 are as follows. The current Cincinnati tax rate is 18 effective 100220 The Income Tax office hours are 800 am to 430 pm Monday through Friday.

If youve been living in the City of Cincinnati chances are youve heard about the tax abatement for new construction and remodeled homes. When you build a new home or invest in renovations your property taxes can go up as you increase the valuation of your property. 100 property tax abatement for 15 years new construction or.

Home Suggest a Dataset. Property tax abatement is available for. Property tax abatement is available.

City of Cincinnati Department of Community and Economic Development Residential Tax Abatement Program 805 Central Avenue Suite 700. Taxpayers can use the Drop-off. If a homeowner spends at least 5000 rebuilding or updating his or her home then he or she can experience a reduction in their.

The City of Cincinnatis Residential Property Tax. Skip to Main Content. City of Cincinnati- Residential Tax Abatements Tyler Data Insights.

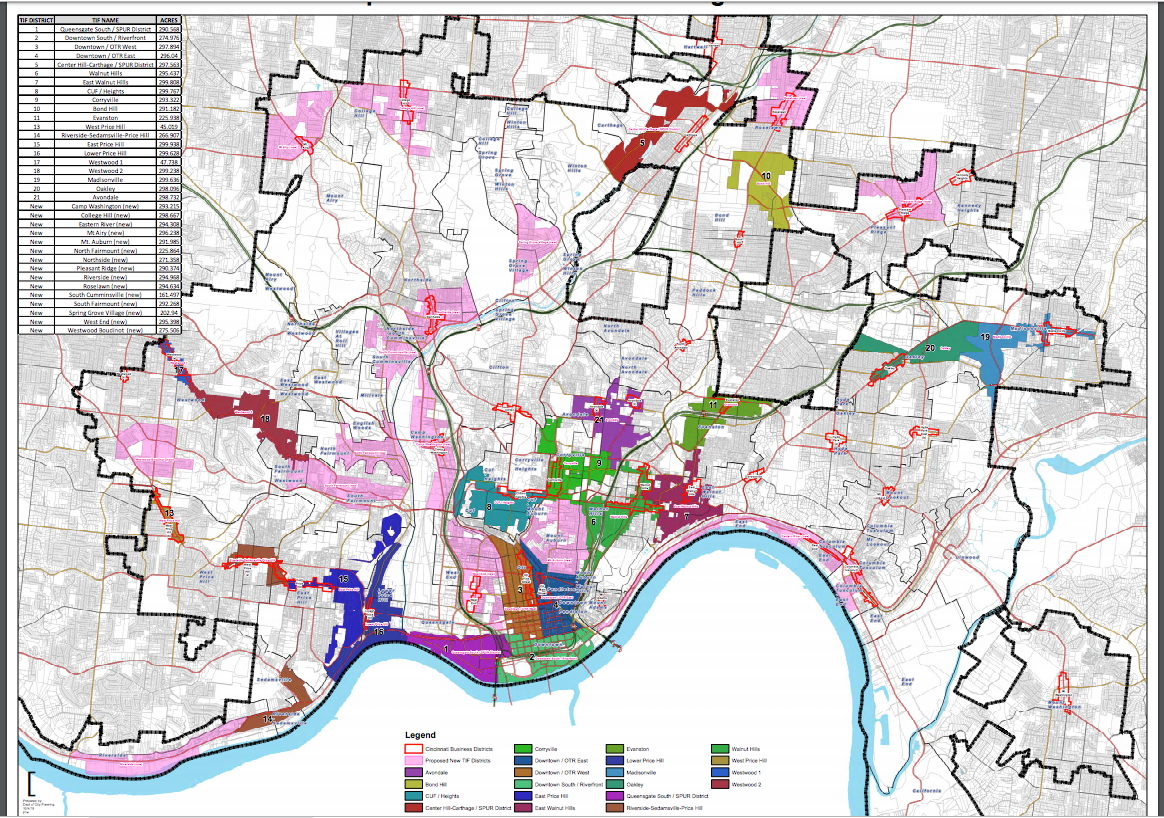

The City of Cincinnatis Residential Property Tax Abatement allows owners to pay taxes on the pre-improvement value of their property for 10-15 years. Tax abatement benefits stay with the property the entire length of the abatement and transfer to any new property owner within the approved time period. This dataset includes commercial tax abatements grants sales of City properties tax incentives tax increment financing TIF and loans issued by the City of Cincinnati.

The City of Cincinnati Department of Community and Economic Development Community Reinvestment Area CRA Tax Abatement Program stimulates revitalization retains residents. Green Cincinnati Education Advocacy 535 Windings Court Cincinnati Ohio 45220 Phone. City Hall has handed out residential abatements totaling an estimated value of 338 million now covering nearly 4400 parcels.

Powered by Industrial Web Development. The City of Cincinnatis Residential Property Tax Abatement allows owners to pay taxes on the pre-improvement value of their property for 10-15 years.

Transforming A City One Home At A Time Cincinnati S Successful Residential Tax Abatement Program U S Green Building Council

The Cincinnati Tax Abatement Is Changing Here S What You Need To Know Buildcollective Com

How Tax Abatement Works In Cincinnati Oh Redknot Homes

Cincinnati Amends Residential Tax Abatement Program Redknot Homes

10 Year Tax Abatement Reduction Passes Philly City Council Whyy

Tax Abatement Cincinnati Trovit

Invest In Neighborhoods Fair Tax Abatement Upcoming Meetings Apr 16 Apr 17

Housing Discrimination Judge Says Cincinnati Lawsuit Can Proceed

Tax Abatement Cincinnati Citywide

The Growing Tiff Over Cincinnati S Proposed New Tif Districts Cincinnati Citybeat

The Blue Ash Tax Abatement Buildcollective Com

How Does Cincinnati S Tax Abatement Work Buildcollective Com

Cincinnati S Coming Tax Abatement Debate Cincinnati Citybeat

City S Residential Tax Abatements Disproportionately Benefit High Income White Neighborhoods Wvxu

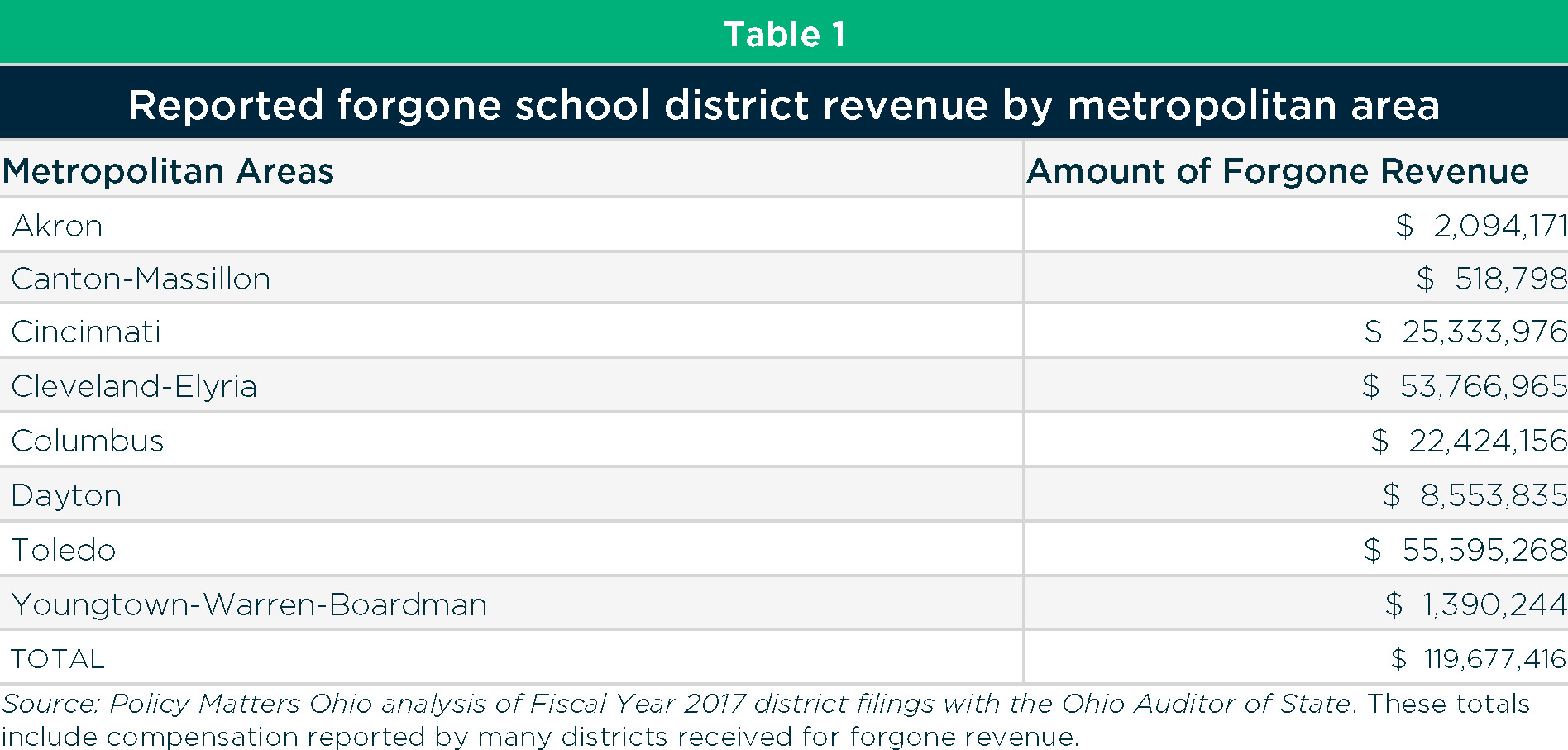

Cincinnati Teachers To City Tax Breaks Costing Schools 8 4m A Year

Reports Strategies Choosecincy

Columbus Property Tax Abatements Transparency And Accountability To Schools And Community

Tipp City Approves Tax Abatement For 1 Million Square Foot Northpoint Site

City Of Cincinnati Community Reinvestment Area Cra Residential Tax Abatement Traditions Group